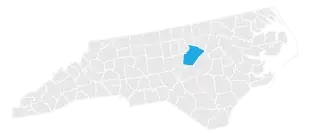

car sales tax wake county nc

Form Gen 562 County and Transit Sales and Use Tax Rates for Cities and Towns Excel Sorted by 5-Digit Zip Historical County Sales and Use Tax Rates. 025 lower than the maximum sales tax in NC.

Wake County 2021 Tourism Industry Report

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200.

. What is the sales tax rate in Wake County. The 725 sales tax rate in Cary consists of 475 North Carolina state sales tax 2 Wake County sales tax and 05 Special tax. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax.

Pay your tax bill by mail in person or online with bill pay your checking account or a credit card. North Carolina collects a 3 state sales tax rate on the purchase of all vehicles. Vehicles are also subject to property.

The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. This is the total of state and county sales tax rates. Historical Total General State Local.

Johnston street smithfield nc 27577 collections mailing. North Carolina generally collects whats known as the highway-use tax instead of sales tax on vehicles whenever a title is transferred. The December 2020 total local sales tax rate was also 7250.

For vehicles that are being rented or leased see see taxation of leases and rentals. The 725 sales tax rate in cary consists of 475 north carolina state sales tax 2 wake county sales tax and 05 special tax. The current total local sales tax rate in Wake County NC is 7250.

Using the tax bill search you can browse billing and payment information for real. In 2005 the North Carolina General Assembly passed a law to create a combined motor vehicle registration renewal and property tax collection system. In addition to taxes.

Pay a Tax Bill. The minimum combined 2022 sales tax rate for Wake County North Carolina is. Motor Vehicles are valued by year make and model.

The state sales tax or highway use tax rate is 3. What is the sales tax on a car purchased in North Carolina. The law transfers responsibility of.

The Wake County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Wake County local sales taxesThe local sales tax consists of a 200. As an example if you purchase a new truck for 60000 then you will have to pay. Sales tax in wake county north carolina is.

Wake County Nc Property Tax Calculator Smartasset

Raleigh North Carolina Nc Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Wake County To Recognize Alternative Form Of Id For Immigrants Refugees Wral Com

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Over 150 Wake County Bus Drivers Skip Shifts During Sick Out Day 2 Board To Vote On Budget Tuesday Wral Com

Used Audi S4 For Sale In Raleigh Nc Cargurus

North Carolina Vehicle Sales Tax Fees Calculator Find The Best Car Price

New Hyundai Cars And Suvs For Sale Wake Forest Nc Raleigh

Used Bmw 7 Series For Sale In Raleigh Nc Cargurus

Wake County North Carolina Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

New Businesses Coming To Wake Forest Town Of Wake Forest Nc

Used Cars Trucks And Suvs For Sale Wake Forest Nc Raleigh Durham

.jpg?w=1600)

You Better Believe In Second Chances Wake County Man Wins More Than 200k In Nc Lottery Abc11 Raleigh Durham

North Carolina Nc Car Sales Tax Everything You Need To Know

Wendell North Carolina Nc 27591 Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders